Higher Costs: SDIRAs often come with larger administrative fees in comparison to other IRAs, as specific elements of the administrative process can not be automated.

Think your Good friend might be starting up another Fb or Uber? With the SDIRA, you may spend money on leads to that you believe in; and perhaps love higher returns.

No, you cannot invest in your individual business enterprise using a self-directed IRA. The IRS prohibits any transactions involving your IRA plus your own enterprise simply because you, as being the operator, are viewed as a disqualified human being.

The tax positive aspects are what make SDIRAs desirable For numerous. An SDIRA might be equally standard or Roth - the account kind you end up picking will rely mainly on your own investment and tax method. Verify with your money advisor or tax advisor should you’re unsure and that is greatest for you.

In advance of opening an SDIRA, it’s crucial that you weigh the potential positives and negatives determined by your specific fiscal goals and threat tolerance.

Numerous investors are astonished to master that applying retirement funds to speculate in alternative assets has become attainable considering the fact that 1974. However, most brokerage firms and financial institutions concentrate on presenting publicly traded securities, like shares and bonds, simply because they absence the infrastructure and know-how to manage privately held assets, for example housing or non-public fairness.

Greater investment options means you can diversify your portfolio beyond shares, bonds, and mutual money and hedge your portfolio towards market fluctuations and volatility.

Set only, for those who’re seeking a tax successful way to construct a portfolio that’s extra tailor-made towards your passions and know-how, an SDIRA may be The solution.

Array of Investment Solutions: Ensure the supplier will allow the types of alternative investments you’re keen on, including real estate property, precious metals, or non-public fairness.

Have the freedom to invest in Pretty much any kind of asset that has a hazard profile that matches your investment system; including assets which have the opportunity for the next amount of return.

This features being familiar with IRS polices, taking care of investments, and staying away from prohibited transactions that can disqualify your IRA. A lack of data could cause expensive mistakes.

Limited Liquidity: Many of the alternative assets that can be held within an SDIRA, for instance real estate property, personal equity, or precious metals, is probably not conveniently liquidated. This may be an issue if you have to obtain cash swiftly.

Real-estate is among the most popular possibilities among the SDIRA holders. That’s since you could invest in any type of real-estate which has a self-directed IRA.

Subsequently, they have an inclination not to market self-directed IRAs, which supply the flexibleness to take a position in the broader variety of assets.

Whether or not you’re a monetary advisor, investment issuer, or other money Skilled, take a look at how SDIRAs may become a powerful asset to mature your organization and realize your Skilled aims.

Though there are various Added benefits connected to an SDIRA, it’s not devoid of its individual disadvantages. A number of the typical main reasons why traders don’t select SDIRAs consist additional reading of:

Complexity and Obligation: By having an SDIRA, you've got more Regulate above your investments, but you also bear far more responsibility.

Of course, real estate is one of our customers’ hottest investments, from time to time termed a real estate IRA. Customers have the option to invest in every thing from rental Qualities, commercial real estate, undeveloped land, home loan notes and much more.

IRAs held at banking companies and brokerage firms offer limited investment options to their customers since they do not need the expertise or infrastructure to administer alternative assets.

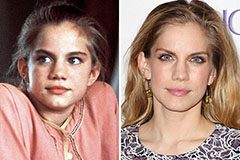

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!